Back

Principal & Interest vs Interest Only

4 min read | Updated 25 May 2023

There’s more than one way to pay off your home loan. Learn which loan option is right for you.

Principal & Interest (P&I) and Interest Only (IO) are two ways of making home loan repayments. Both get you from home loaner to homeowner but in different ways.

Principal and Interest is the fastest way to get from loaner to owner, but Interest Only might be just right when you need some flexibility in your cashflow. It’s a great short term option to lower your home loan repayments for a period of time.

Dive in to understand which repayment type suits you best.

What is a Principal & Interest home loan?

On a Principal & Interest home loan each repayment pays off your principal, which is the amount you’ve borrowed, and the interest your lender charges you on the principal.

What are the benefits of Principal & Interest (P&I)?

Pay off your home loan faster. See our home loan hacks.

Ultimately you will pay less interest over the life of your loan compared to Interest Only as you are paying down your principal over time. The less principal you have, the less interest you pay.

If property values decrease, you are less likely to be in a position where your loan is greater than the value of the property.

Principal & Interest variable rates are generally lower than Interest Only.

What you should know about Principal & Interest home loans

Your repayments will be higher than Interest Only.

If you are an investor, Principal and Interest repayments may be less tax-efficient than Interest Only repayments. A reminder that tax advice is not our thing, so speak to an expert!

What is an Interest Only home loan?

On an Interest Only home loan, each repayment only pays off the interest your lender charges you on the principal.

Usually this is for a set period, for example 3 years and during this period, your principal balance remains the same.

After the Interest Only period ends, you revert to a Principal & Interest home loan, where your repayments increase to pay off your principal and the interest.

What are the benefits of Interest Only?

Your repayments are lower than Principal & Interest repayments as you are only paying the interest charged. You can free up cashflow which could be a good short-term option when you need the extra cash for life surprises or new plans:

You want to save up for unexpected life surprises or put away money for rainy days.

You want to boost your savings for planned renovations, maintenance or investments.

You need some repayment relief in a high loan interest rate environment

You’re a savvy investor and want to maximise tax benefits and build up savings to achieve your next investment goal faster.

What you should know about Interest Only

You can free up cash when you need it, but it could cost more over the life of the loan. Calculate the additional cost of interest only over the period you’ll use it.

Have a plan for when you will start paying the principal as your repayments would be higher once you move onto principal and interest repayments after the interest only period ends.

The principal and interest repayments will also be higher compared to if you had started with a Principal & Interest loan from the beginning as you now have a shorter loan term to pay off your principal.

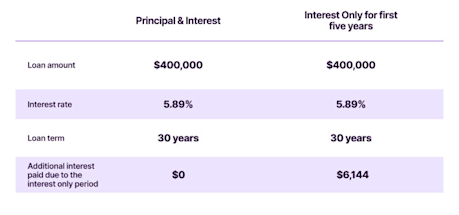

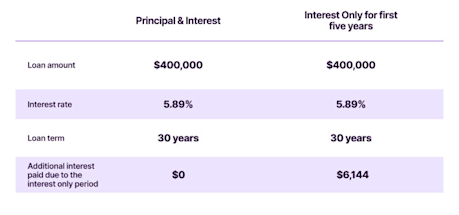

Principal & Interest vs Interest Only comparison

We offer both options to suit where you’re at. Make sure you understand that by choosing Interest Only, you can free up your cash flow when you need it, but it could cost more over the life of the loan. Do your sums before you commit and have a plan for when you switch to Principal & Interest.

For example, for a 30-year loan of $400,000 at a variable interest rate of 5.89% - and choosing the first year of the loan to be Interest Only - you would pay an extra $6,144 over the life of the loan compared to Principal & Interest. Your monthly interest only repayments would be $1,997 and after 1 year, your monthly repayments will move to principal and interest at $2,400.

Unlike most other lenders, Athena lets you switch to Principal & Interest at any time and make unlimited additional repayments on your loan without being penalised for it. The extra repayments you make would be held in your redraw or offset account, reducing your loan balance and saving you interest.

This means your Interest Only repayments would be less. When your selected Interest Only period ends, you’ll automatically switch to the principal and interest rate loan relevant to your LVR tier.

Find out which interest repayment suits your financial circumstances and what the difference is in repayments between Principal & Interest and Interest Only on our loan calculator.

You’ll be blown away at how much time and money you’ll save by switching to Athena. We have loan features built to make it easy to take control of your home loan no application fees, flexible monthly payments and fast turn-around loan applications. And just watch what happens if you use hacks to pay your loan down faster.

Want to talk to one of our Aussie based home loan experts? Book a call today.

You’ve got nothing to lose except your home loan!

Start saving a whole lotta time and money

^Comparison rate calculated on a $150,000 secured loan over a 25-year term. WARNING: Comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate. Comparison rates for variable interest only loans are based on an initial 5-year interest only period. During an interest only period, your interest only payments will not reduce your loan balance. This may mean you pay more interest over the life of the loan.