REFINANCING THE HOME YOU LIVE IN

Switch and you're

Home Sweet Loan

Why choose Athena?

Fiercely fair value

Changing home loans for good is in our DNA and can save you money. So far we've saved thousands of Aussies a total of $704m** and counting.

Need to borrow more?

Unlock equity easily and get maximum borrowing power.

Flexibility without the fees

Easily change your loan type, repayment frequency or top-up when you need, for free, on our Straight Up and Power Up loans.

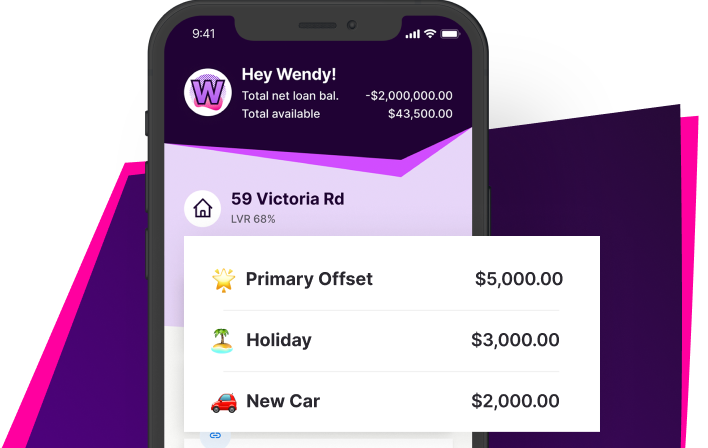

Offset and save

With Athena's offset accounts, you can stash your cash any way you want with our Power Up loan. The more money you put in your offset, the less interest you'll pay.

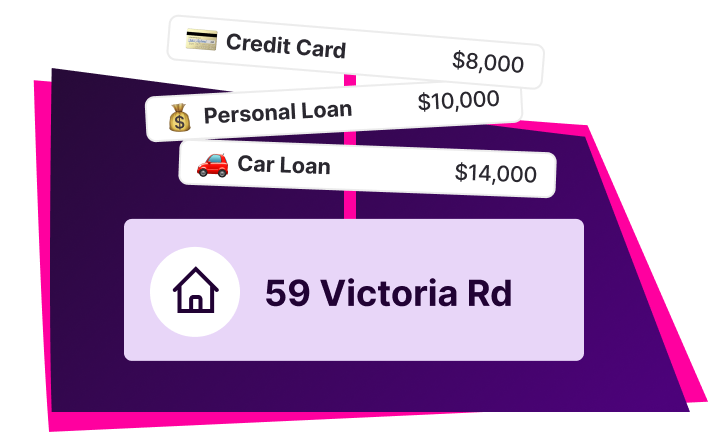

Hedge your bets or consolidate debts

Customise your split loans across fixed, variable, owner, investor, P&I and IO or different loan terms (max 10). Consolidate up to four debts onto the one interest rate.

Self-employed or want to avoid LMI?

Our Tailored loans are custom-made for you. Our lite doc loan makes it easy for self-employed borrowers who need alternative income verification options. For those wanting to borrow more than 80% of their home’s value without paying LMI, we’ve got you covered with our 80-85% LVR loan.

Doing business for good

Balancing profit with people and purpose, Athena is a certified B-Corp. Proof we're committed to a better, fairer world. B-Corps are businesses that meet high standards of social and environmental performance, accountability, and transparency.

The home loan wrecker

Since our launch in 2019 we've settled over $6.3 billion in loans for Aussies. Home loans are all we do, and we're obsessed with changing them for good. We continue to rewrite the rules, creating tools, products and policy that put the power back in our customers' hands.

Our loans for Home Owners

Simple or sophisticated, stay great rates - we’ve got a loan for your property.

How do I...?

No fee loans

Choose an Athena loan with no fees and avoid paying an average of $8,650 in fees with other lenders4. Pay your loan off faster instead!Drop your own rate

With AcceleRATES the more you pay down your loan, the more we'll lower your interest rate - automatically2.Don't pay loyalty tax

Loyalty tax is when existing customers are charged a higher interest rate than new customers. UNFAIR. All customers get the same great rate on like-for-like loans3 at Athena.Offset and save

Pay less interest by salary crediting into your offset. Set up multiple offsets to help bucket savings goals.

"We're now saving a lot with our new loan! I simply can't find a better home loan package than Athena's for paying off my mortgage sooner."

TAKE THE NEXT STEP

Calculate your numbers

We’ve slashed the time, paperwork and hassle. Get a quote fast and start saving!

Calculate

Compare your current loan, check your eligibility and calculate your repayments.

No credit checks here!

3 mins

1

Apply

Our 15 minute online application is simple and gets you a decision in 60 seconds.

15 mins

2

Switch

Once approved, review and return your docs. We’ll get you settled and saving fast.

3

Real Home Owners.

Real love.

Join the thousands of happy Athena customers and hear their stories on Trustpilot.

LOCAL KNOWLEDGE

Help when you need it

Our Aussie-based Loan Experts are here if you need a hand. Reach us by phone, SMS or live chat to ask a question and they’ll even do the application with you.

Learn more about choosing the right home loan

Principal & Interest vs Interest Only

It’s all about paying it off or putting it off. What is a Principal & Interest home loan?

Hacks to pay off your home loan faster

We'll help you pay down your home loan faster with our simple shortcuts.

Do you pay less interest if you pay weekly?

Shave thousands and years off your loan by understanding repayment calculations.

FAQs

What’s the process to switch over?

Am I eligible to refinance to Athena?

Which AcceleRATE tier will I be on?

I want to refinance multiple properties over to Athena

Can I refinance with equity release?

Can I refinance to consolidate debt?

How do valuations work at Athena?

How long does it take to switch over?

Will I be charge penalty fees by my current lender?

Our disclaimers

Please take a moment to read our disclaimers, thanks!

Athena's disclaimers