BUYING AN INVESTMENT PROPERTY

Superpowers for

the investor edge

RATES FOR

INVESTORS FROM

5.84

%

P.A.

Variable & Comparison^

Why choose Athena?

Fiercely fair value

Changing home loans for good is in our DNA and can save you money. So far we've saved thousands of Aussies a total of $704m** and counting.

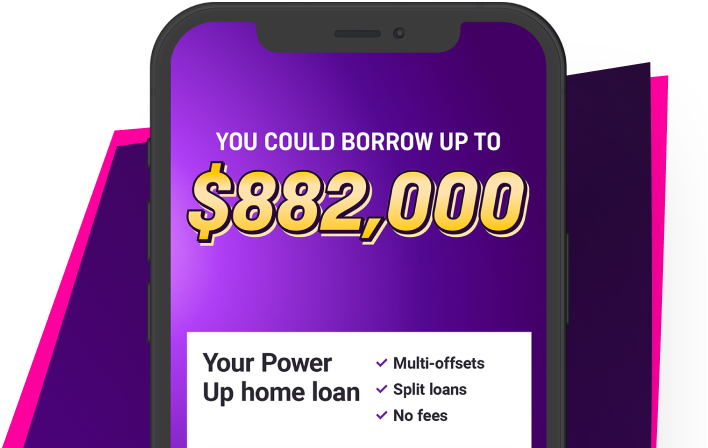

Get max borrowing power

Grab the investment you really want by maximising your borrowing power with Athena. We get you fully credit pre-approved in days, and you can make changes to your Straight Up or Power Up loan without being charged.

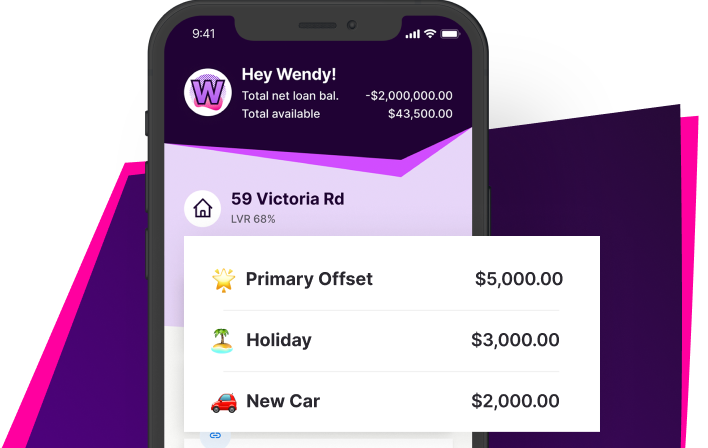

Offset and save

With Athena's offset accounts, you can stash your cash any way you want on our Power Up loan. The more money you put in your offset, the less interest you'll pay.

Optimise your loan structure

Split up to 10 loans against your property. Each split loan is customisable — choose fixed or variable, owner occupier or investment, P&I or IO and set different loan terms.

Investor Experts who get you

Our Experts understand investors. Talk to them about unlocking equity, structuring your loans or maximising your borrowing power6. They're on-hand to help you win and are just an SMS or call away.

Self-employed or need a lower deposit loan?

Our Tailored loans are custom-made for you. Our lite doc loan makes it easy for self-employed borrowers who need alternative income verification options. For borrowers with a lower deposit, we’ve got you covered with our 80-85% LVR loan, no LMI needed. And we cater for investors who are buying property through a company or trust.

Doing business for good

Balancing profit with people and purpose, Athena is a certified B-Corp. Proof we're committed to a better, fairer world. B-Corps are businesses that meet high standards of social and environmental performance, accountability, and transparency.

The home loan wrecker

Since our launch in 2019 we've settled over $6.3 billion in loans for Aussies. Home loans are all we do, and we're obsessed with changing them for good. We continue to rewrite the rules, creating tools, products and policy that put the power back in our customers' hands.

Our loans for Investors

Simple or sophisticated, stay great rates - we’ve got a loan for your property.

How do I...?

Investor friendly borrowing power

Our extra friendly borrowing policy means investors can get the property they want, where they want, sooner.Super fast, accurate pre-approval

We get you bid ready in a flash. Your credit approved 90 day rate-locked pre-approval is done in days, not weeks.The full Investor toolkit

Couple your borrowing power with fast equity release, top-ups, split loans, multi-offsets, no fee options, cross-collateralisation and super sharp IO rates.

“Before coming to Athena, my customer was told he’d have to wait three more months before he could borrow the amount he wanted. We were able to get him pre-approved in two days and a few days later, he purchased a property!”

TAKE THE NEXT STEP

Calculate your numbers

We’ve slashed the time, paperwork and hassle. Get a quote fast and start owning!

Calculate

Calculate your borrowing power and your repayments; check your eligibility. No credit checks here!

3 mins

1

Apply

Our online application is simple. Submit and we'll get you pre-approved in days not weeks.

15 mins

2

Settle

Once approved, review and return your docs. We’ll get you sorted and into your new home.

3

Real Investors.

Real wins.

Join the thousands of happy Athena customers and hear their stories on Trustpilot.

LOCAL KNOWLEDGE

Help when you need it

Talk to our dedicated Investor A-team about unlocking equity, structuring your loans or maximising your borrowing power6. They’re ready to help via rapid response SMS or live chat so you don’t need to wait on hold! If you’d prefer a phone convo, they’d love to talk.

Want to learn more about getting ahead in the property market?

Property equity & home loan structuring

How to unlock equity in your property and gain insights into home loan structuring to win.

How to invest in property: A starting guide

We’ve put together insights, tips and tricks, so your first steps into real estate are supported.

Property investor strategies, what's yours?

See how creating a game plan and structuring your investment property loans can work for you.

FAQs

What will my repayments be with Athena?

How much deposit will I need and how much can I borrow?

How do I cash-out from the equity I have from an existing property?

Can you have an offset account with an investment property?

Can I cross-collateralise my loan across multiple properties?

What is positive and negative gearing?

How long does the whole process take?

Our disclaimers

Please take a moment to read our disclaimers, thanks!

Athena's disclaimers