BUYING A HOME TO LIVE IN

Own your home.

Own your loan.

Why choose Athena?

Fiercely fair value

Changing home loans for good is in our DNA and can save you money. So far we've saved thousands of Aussies a total of $704m** and counting.

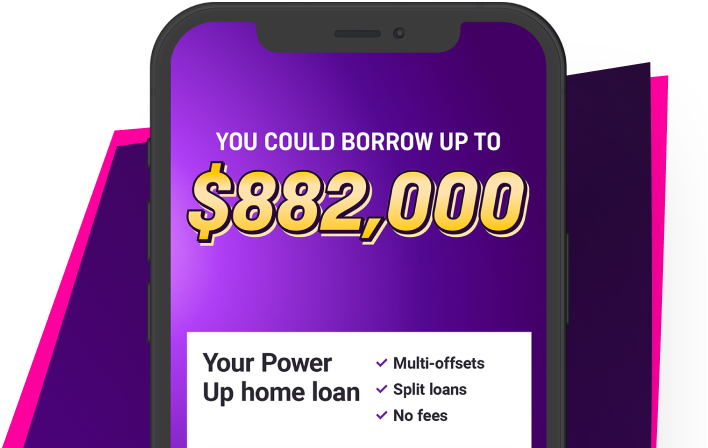

Max borrowing power

Grab the home you really want by maximising your borrowing power with Athena. We get you fully credit pre-approved in days, and you can make changes to your Straight Up and Power Up loan without being charged.

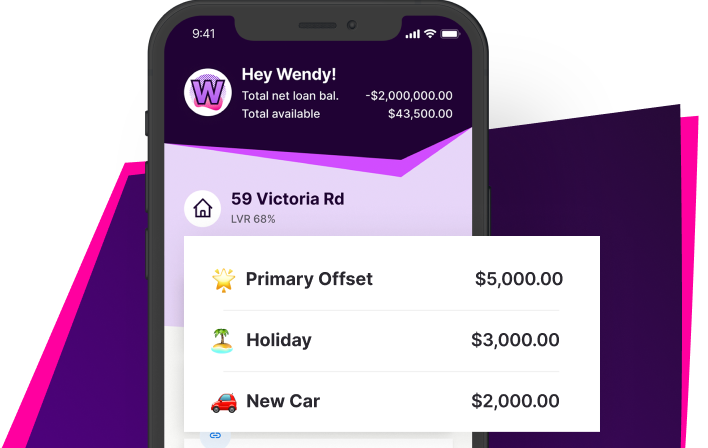

Offset and save

With Athena's offset accounts, you can stash your cash any way you want with our Power Up loan. The more money you put in your offset, the less interest you'll pay.

Easily split your loan

Split up to 10 loans against your property with our Power Up loan. Customise each split loan — choose fixed or variable, owner occupier or investment, P&I or IO and set different loan terms.

Self-employed or need a lower deposit loan?

Our Tailored loans are custom-made for you. Our lite doc loan makes it easy for self-employed borrowers who need alternative income verification options. For borrowers with a lower deposit, we’ve got you covered with our 80-85% LVR loan, no LMI needed.

Doing business for good

Balancing profit with people and purpose, Athena is a certified B-Corp. Proof we're committed to a better, fairer world. B-Corps are businesses that meet high standards of social and environmental performance, accountability, and transparency.

The home loan wrecker

Since our launch in 2019 we've settled over $6.3 billion in loans for Aussies. Home loans are all we do, and we're obsessed with changing them for good. We continue to rewrite the rules, creating tools, products and policy that put the power back in our customers' hands.

Our loans for Home Owners

Simple or sophisticated, stay great rates - we’ve got a loan for your property.

How do I...?

Borrower friendly policy

Get the dream home you want - fast - with more borrowing power thanks to our friendly policies.Tools and expertise

Use our borrowing power calculator to do the maths; text or talk to our dedicated team of Aussie experts to workshop your scenario.Money saving hacks that last

Get more than just borrowing power with fee-free offsets, great rates that stay great, and fiercely fair value.

“I had a customer who couldn’t find a lender that would allow her to borrow the amount she wanted. She was beyond shocked at how much she could borrow with Athena thanks to our policies and we got her application submitted the same day over the phone.”

TAKE THE NEXT STEP

Calculate your numbers

We’ve slashed the time, paperwork and hassle. Get a quote fast and start owning!

Calculate

Calculate your borrowing power and your repayments; check your eligibility. No credit checks here!

3 mins

1

Apply

Our online application is simple. Submit and we'll get you pre-approved in days not weeks.

15 mins

2

Settle

Once approved, review and return your docs. We’ll get you sorted and into your new home.

3

Real Home Owners.

Real love.

Join the thousands of happy Athena customers and hear their stories on Trustpilot.

LOCAL KNOWLEDGE

Help when you need it

Our Aussie-based Loan Experts are here if you need a hand. Reach us by phone, SMS or live chat to ask a question and they’ll even do the application with you.

Check out our tips for buying your dream home

7 Steps to Buying a House in Australia

Here are all the steps in buying a home – right from the initial planning to the official transfer of title.

How to buy a house at auction

It doesn’t matter if you’ve never bought property at auction before, it’s all about sticking to a plan and being prepared.

Understanding the home loan process

Have a read of these 5 steps to getting a home loan, so you’re one step ahead when you’ve found the right place to buy.

FAQs

Q: How much can I borrow?

Q: How do you work out how much I can borrow?

Q: Why can I borrow less/more with Athena compared to other lenders?

Q: How much deposit do I need to take out a home loan?

Q: What's the home loan process like if I want to buy a property?

Q: What is a pre-approval and unconditional approval? What are the differences?

Q: How long does it take to receive pre-approval?

Q: How long does it take to receive unconditional approval?

Q: How long will settlement take?

Q: What are the costs involved with buying property?

Q: Do you lend to First Home Buyers?

Our disclaimers

Please take a moment to read our disclaimers, thanks!

Athena's disclaimers