Back

5 ways to get ahead as rates rise

05 July 2022 - updated 15 Sept 2022

The Reserve Bank has made it's fifth increase to the cash rate this year.

The latest increase of 50 basis points, announced on 6th September 2022, means the cash rate is now 2.35%.

It’s game-on to get your finances in great shape as interest rates and the cost of living begins to head higher.

The Reserve Bank hasn’t hiked rates since late 2010 when they were 4.75%¹. We then saw a remarkable run of rate cuts, leading to a cash rate that remained unchanged since November 2020 - that is, until May 2022. And we’ve seen monthly increases since.

While rates were low, many of you have took the opportunity to get ahead on your home loan. But as we head out of the pandemic, amidst global and local economic pressures, things are changing, many of us are trying to manage our finances in the face of this new normal.

The latest figures show inflation sitting at 6.1%². And it’s not just happening here in Australia. Inflation is hitting highs not seen for years in many countries globally.

The Reserve Bank points to three factors driving inflation: COVID-driven supply issues, Russia's invasion of Ukraine (both countries are big suppliers of products like fuel and food), and strong global demand as economies recover from the pandemic³.

So…why raise interest rates?

Overall, the Aussie economy isn’t in bad shape with low unemployment and better standards of living than many other developed countries. And a large part of the Reserve Bank’s role is to help keep it this way, by using interest rates to ensure the economy finds the right balance as inflation and demand changes.

Given higher than forecast inflation, the Reserve Bank needed to act quickly and address spiralling consumer demand by beginning the process of raising rates.

The upshot is that a higher cash rate will hopefully help the economy get back on track while hoping to keep a lid on inflation. And in many ways, initially an uptick in rates will simply see us make a return to how they were just before COVID, which even in our pandemic fuddled brains isn’t all that hard to remember.

But, with over a decade since the last set of rate hikes, handling the ongoing rising home loan rates for the journey ahead is likely to be a new experience.

Rising rates are no fun when you have a home loan. We get that. But there are steps you can take to protect yourself.

1. Know your numbers

Get a feel for what may lie ahead. It may seem daunting, but knowledge ahead of time equals power to do something about it.

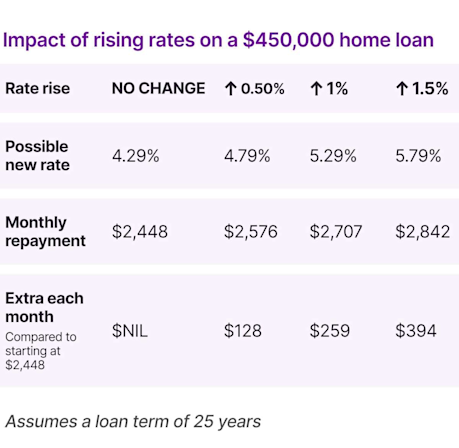

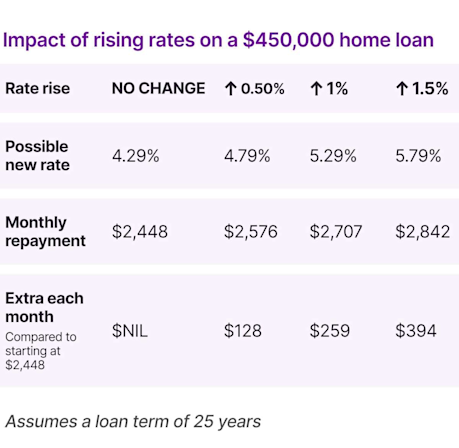

Our number crunching below shows how a rate hike of 0.50% on Athena's current lowest rate of 4.29% (to 4.79%) would increase monthly repayments by $128 on a $450,000 home loan with 25 years.

Now we all know that rates could go higher over time, making it important to think long term as that’s where you can make a difference now. Looking at your numbers now means you can adjust your budget ahead of time.

Want to play with some other scenarios? We rate ASIC’s money smart calculator as a great way to easily test out your new repayments based on different interest rates and fees. Just remember that the average interest rate quoted in the ‘My interest rate’ section is from July 2022, so it doesn’t take into account the cash rate increases over the last two months.

2. Use your Athena Offset to build a buffer

Your Athena Offset account is here to help you save. The more you can tuck into your offset, the more you can save on loan interest and build a buffer you can dip into later.

Unlike most other lenders, you pay zero fees with Athena’s 100% Offset so the extra savings all flow your way.

That’s why it’s worth growing the balance of your Athena Offset. Talk to your employer about paying your salary into your offset, or simply move money in yourself whenever you like. Watch your offset buffer grow, the amount you are paying in interest shrink and think of it as your war chest against rising rates.

Having a buffer equal to about three months’ worth of salary in your offset is a great starting point. It provides the reassurance of rainy day savings, while helping you save a bundle on loan interest.

You can also look at the scenarios you created earlier and see how much extra you might be paying in mortgage repayments in years to come. Set goals for your buffer to have 3, 6 or 12 months of these repayments ready in your offset, saving you interest for when the time comes.

3. Shine a spotlight on spending

Reviewing your spending helps you pinpoint areas where you can cutback without too much pain, plus it puts you in a stronger position to handle higher repayments and general cost of living increases.

Here are a few ideas to get started:

Track your spending

Whether you keep paper notes or use an app, knowing exactly how much you’re spending month on month is the starting point to knowing what you can cut back.

Think about trimming non-essentials

We all spend on a few nice-but-not-necessary items, and these can be the first to be reined in to manage rising rates. Rethink multiple streaming services. Put a weekly limit on takeouts and home delivered meals. Or put that unused gym membership to rest. It can all add up to get cash back in your pocket.

Check you’re getting the best deal on essentials

From power and phone to home insurance, it’s easy to shop around online, compare costs, and make a switch to score better value.

Aim to scale back non-essential debt like credit cards or buy now, pay later

Reaching for your debit card at the check-out can help you stick to a spending budget.

Set spending limits on individual categories within your budget

Use your spreadsheet or your app's tools to track when you are hitting them.

Income matters

Don’t forget that your income matters as much as your expenses. Look at how you can boost your income by talking to your boss about a pay rise.

Wages growth in Australia has been limited for a long time and given the low unemployment conditions, this could be your opportunity to negotiate a higher salary. Think about asking your employer the question, “What would you pay to replace me?”.

Perhaps tap into your inner entrepreneur to start, or invest further, in your side hustle.

4. Take control with AcceleRATES

Athena's variable AcceleRATES let you control the rate you pay. The more you pay down your loan, the more we lower your rate and repayments.

Check out your Loan-Value-Ratio in your Home Hub portal or Athena App, and do the sums to know how much you can comfortably shift from your offset or savings into your home loan to take advantage of a lower AcceleRATES tier.

This will reduce your rate and repayments, give you money back in your pocket every month and save you more in interest.

But in these conditions, be sure to leave some rainy day money aside as paying it into your loan locks the cash away meaning you need to apply to get it back out.

5. Talk to us about your options

You can always talk to the team at Athena about options to help you navigate higher interest rates. You might consider moving to a fixed rate, or moving from principal and interest payments to interest only repayments for a while. You can check out the rates here.

6. Congratulate yourself

As an Athena customer, you’re already paying one of the lowest new AND existing customer rates in market and not wasting a cent in fees.

As Australia’s first loyalty penalty-free lender, Athena’s Automatic Rate Match is our promise that we won’t charge existing customers more than new customers on a like-for-like loan⁴.

So, unlike other lenders, we won’t raise rates for existing customers while luring in new customers on lower rates. Meaning you don’t need to worry about being lumbered with the so-called “Loyalty Tax”.

Taking these steps will help to put you on the front foot when it comes to navigating today’s challenging rising interest rate environment.

¹ https://www.rba.gov.au/statistics/cash-rate/

² https://www.rba.gov.au/speeches/2022/sp-gov-2022-09-08.html ₃ ₃ https://www.rba.gov.au/monetary-policy/rba-board-minutes/2022/2022-04-05.html

⁴ A like-for-like loan means the product name (eg. Owner P&I Var) and LVR tier (eg. Liberate, Evaporate, Celebrate) advertised to new customers must be the same product name and the same LVR tier that you have as an existing customer. Applies to variable loans only. The way we construct and name products may include a combination of the loan’s purpose (eg. Owner Occupier, Investor), repayment type (eg. P&I, IO), loan type (eg. Variable), borrower type, different features or specific qualification criteria. None of these criteria will be designed to favour new customers over existing customers. If we ever tempt new customers with a lower rate for our like-for-like loan, anyone who’s on it will get the automatic rate-match. Sweet. It’s an Aussie first!